Pawnshops are a great option for those looking to borrow money, as well as those who want to offer their possessions as collateral. They can offer lower interest rates than other places, and they don’t require any credit checks! But there are some things you should know before visiting one – here’s 4 of them!

1. The Perks

If you’ve ever thought about pawning something, you know that you generally receive much less than it’s worth when selling it to a pawn shop. But what people don’t always consider is all the perks they can enjoy by using their loans to buy groceries, pay their phone bills, etc. Even selling your antiques and valuables like jewelry at Maxferd can help you relieve some struggles. Instead of making 10 different stops throughout town to complete errands, now everything can be taken care of in one place – and with interest rates as low as 7% (or even lower!) if paid back on time, what’s there to lose?

Also, interest rates are low, but they’re not 0%! Some would consider this a downside to pawning or borrowing through a pawn shop, but it’s all about the bigger picture. Compare that 7% interest rate with what you’d pay if you bought something on credit – oftentimes much more than that. But, if you think about it, 15-30% is expensive for any purchase no matter how big or small – so why not use the money instead toward something you want? It’ll save you even more in the long run!

2. Loans

They’re great for those who need work done but don’t have the cash. Maybe the car could use some fixing-up, or maybe you’ve always wanted to learn how to play the guitar. Why not get a loan for some tools and pay them off using your new skills? If you need something done but don’t have the cash on hand, pawn shops are an excellent option. Pawnshops offer loans as short as 1 day or as long as 12 months, so you don’t have to push yourself to earn the money back.

The principles of getting a loan in a pawnshop are just like getting a loan in most other places: You will need to prove you have a source of income and that the money is yours. This can be done by showing your paystub, or even better, having your checking account linked to the pawnshop for direct deposits.

Something people don’t realize is that pawnshops also offer payday loans (although they may go by different names). These are short-term loans that let you borrow an extra $100 up to $1000 which you’ll repay in full when your next paycheck comes through. A payday loan can truly help out in a pinch – whether it’s for car repairs, doctor bills due to an accident, etc. Repayment terms and interest rates vary by the pawnshop, so do your homework and choose the best deal.

3. Sell Your Valuables

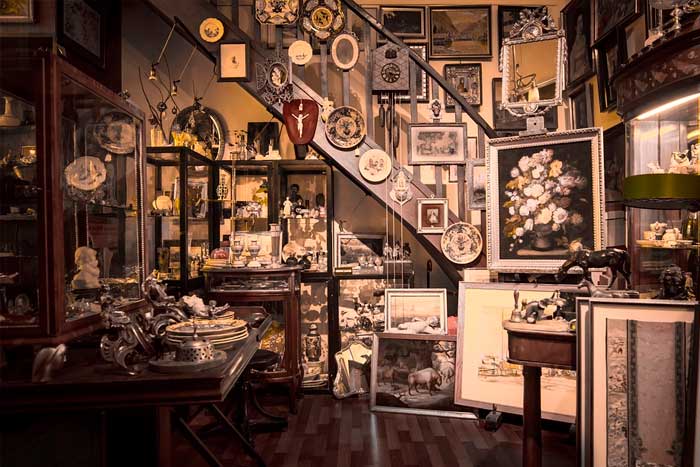

When times get tough, sometimes you have to sell those valuables that mean a lot to you – the ones that are just too expensive to keep locked up in storage. Maybe an anniversary or birthday is coming up soon – this is a great way to scrape together some extra cash without incurring any debt! Not only does it help out cash-strapped consumers but also helps participating pawnshops afford new items for their inventory, which will hopefully make everyone happy! Selling your valuables is as easy as bringing them in and filling out a short form that they’ll provide at the counter. You can expect to get around 50-70% of what you think it’s worth if it’s an item their shops typically buy, and more than 80% if they’re looking for something rare or unique.

4. You Can Trust Pawnshops

They can be trusted more than most other places. Even though they deal with second-hand items, there’s no reason to suspect that the pawnshop owner is dishonest – there’s a lot of money on the line, and it’s difficult to take something that isn’t yours! So don’t be afraid to use their services if you need some quick cash.

However, don’t assume your possessions will be safe. You may assume that you won’t have to worry about your borrowed items being sold off by the pawnshop if they’re not returned immediately, but you can’t take that for granted. If someone doesn’t return the item on time and it must be returned right away, you could risk losing the object altogether! Make sure there are no mistakes when using collateral – talk with an employee before getting started to discuss any concerns or questions.

In conclusion, pawn shops have a reputation for being less than trustworthy – when in reality, they provide an amazing resource if you need money but don’t want to spend any of your own. They offer low-interest rates and quick service so you’ll be able to get the cash in hand quickly if that’s what you need! And since pawnshops have been around for hundreds of years, it means that they’re here to stay. No matter where you go, there are always potential risks involved. It never hurts to do some extra research before making decisions about your financial future or where to take your valuables!